7 Property Sales

We have a survey open right now that we invite you to fill out.

It is worthwhile to study trends in property sales and the variables that affect this as everybody needs somewhere affordable to live.

This lesson examines property sales in North Shore city, using data recorded each December between 1999 and 2007. There are a total of 3788 properties, with about 420 being sold per December. This data was supplied by the Real Estate institute of New Zealand, with analysis conducted by Neil Binnie (Auckland University of Technology).

Data

There is 1 file associated with this presentation. It contains the data you will need to complete the lesson tasks.

Video

Objectives

Tasks

0. Read and Format data

0a. Read in the data

First check you have installed the package readxl (see Section 2.6) and set the working directory (see Section 2.1), using instructions in Getting started with R.

Load the data into R.

The code has been hidden initially, so you can try to load the data yourself first before checking the solutions.

Code

#loads readxl package

library(readxl)

#loads the data file and names it property

property<-read_xls("North Shore 99-07 December.xls")

#view beginning of data frame

head(property) Code

#loads readxl package

library(readxl) Warning: package 'readxl' was built under R version 4.2.2Code

#loads the data file and names it property

property<-read_xls("North Shore 99-07 December.xls")

#view beginning of data frame

head(property) # A tibble: 6 × 12

Year Zone Suburb List …¹ Selli…² `Sell date` List …³ Days …⁴ Numbe…⁵

<dbl> <dbl> <chr> <chr> <dbl> <dttm> <chr> <chr> <chr>

1 1999 7 Takap… 525000 525000 1999-05-24 00:00:00 36294 10 0

2 1999 7 Takap… 530000 530000 1999-08-20 00:00:00 36294 98 0

3 1999 7 Takap… 565000 565000 1999-06-03 00:00:00 36294 20 0

4 1999 6 Birke… 135000 120000 1999-11-24 00:00:00 36445 43 1

5 1999 3 Albany 159000 159000 1999-11-19 00:00:00 36434 49 2

6 1999 4 Brown… 149000 135000 1999-12-20 00:00:00 36448 66 2

# … with 3 more variables: Type <chr>, `Land Area m2` <chr>, GV <chr>, and

# abbreviated variable names ¹`List Price`, ²`Selling Price ($)`,

# ³`List Date`, ⁴`Days to Sell`, ⁵`Number of Bedrooms`

# ℹ Use `colnames()` to see all variable namesMost of the variables in this data frame are self explanatory, although there are 2 exceptions. Type is a factor variable indicating the type of property, with levels APT= Apartment, H & I = Home and Income, R = Residential, RIB= Residential Investment Block, RS = Residential Section, TH = Town House, and U = Unit. GV is the government valuation of the property for rating purposes, this is sometimes used as an approximation of property worth.

0b. Format the data

Recode List Price, Days to Sell, Number of Bedrooms, Land Area m2 and GV as numeric variables.

Code

property$`List Price`<-as.numeric(property$`List Price`)

property$`Days to Sell`<-as.numeric(property$`Days to Sell`)

property$`Number of Bedrooms`<-as.numeric(property$`Number of Bedrooms`)

property$`Land Area m2`<-as.numeric(property$`Land Area m2`)

property$GV<-as.numeric(property$GV)Code

property$`List Price`<-as.numeric(property$`List Price`)Warning: NAs introduced by coercionCode

property$`Days to Sell`<-as.numeric(property$`Days to Sell`)Warning: NAs introduced by coercionCode

property$`Number of Bedrooms`<-as.numeric(property$`Number of Bedrooms`)Warning: NAs introduced by coercionCode

property$`Land Area m2`<-as.numeric(property$`Land Area m2`)Warning: NAs introduced by coercionCode

property$GV<-as.numeric(property$GV)Warning: NAs introduced by coercion1. Summary Statistics, Histogram, Clean data

1a. Summary Statistics

First calculate some descriptive statistics (number of observations, mean, quartiles, maximum) for various continuous variables in the data set above, in order to see if there are any interesting features or obvious strange values. This can be achieved using the apply() function.

The variables of interest are Selling Price ($) (column 5), Days to Sell (column 8), Number of Bedrooms (column 9), Land Area m2 (column 11), and GV (column 12).

We use MARGIN=2 to indicate we want summaries for each column (MARGIN=1 summarises by rows).

FUN= specifies the function we wish calculate for each column. Note when FUN=quantile there is an additional argument probs= to give the quantile level. Sometimes it is necessary to include na.rm=T to avoid errors from missing data.

Code

#number of observations

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=length)

#minimum

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=min,na.rm=T)

#mean

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=mean,na.rm=T)

#lower quartile

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=quantile,probs=0.25,na.rm=T)

#middle quartile/median

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=quantile,probs=0.5,na.rm=T) Also calculate the upper quartile and the mean for the variables of interest.

Code

#number of observations

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=length) Selling Price ($) Days to Sell Number of Bedrooms Land Area m2

3788 3788 3788 3788

GV

3788 Code

#minimum

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=min,na.rm=T) Selling Price ($) Days to Sell Number of Bedrooms Land Area m2

59000 0 0 0

GV

0 Code

#mean

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=mean,na.rm=T) Selling Price ($) Days to Sell Number of Bedrooms Land Area m2

434772.86510 56.48828 3.19017 2945.26554

GV

319314.25759 Code

#lower quartile

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=quantile,probs=0.25,na.rm=T) Selling Price ($) Days to Sell Number of Bedrooms Land Area m2

260000 15 3 533

GV

197000 Code

#middle quartile/median

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=quantile,probs=0.5,na.rm=T) Selling Price ($) Days to Sell Number of Bedrooms Land Area m2

361000 31 3 685

GV

280000 Code

#upper quartile

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=quantile,probs=0.75,na.rm=T) Selling Price ($) Days to Sell Number of Bedrooms Land Area m2

515000.0 60.0 4.0 900.5

GV

400000.0 Code

#maximum

apply(property[,c(5,8,9,11,12)],MARGIN=2,FUN=max,na.rm=T) Selling Price ($) Days to Sell Number of Bedrooms Land Area m2

8300000 1552 16 4000000

GV

3500000 There appear to be some unrealistic minimum values for certain variables e.g. 0 Days to Sell and Land Area of 0 metres squared.

Based on the difference between the upper quartiles (values 75% of the data is less than) and the maximums, some variables are also highly skewed e.g. Selling Price ($515,000 upper quartile and $8,300,000 maximum), Number of Bedrooms (4 and 16), Land Area (900.5 m2 and 4,000,000 m2).

1b. Histogram

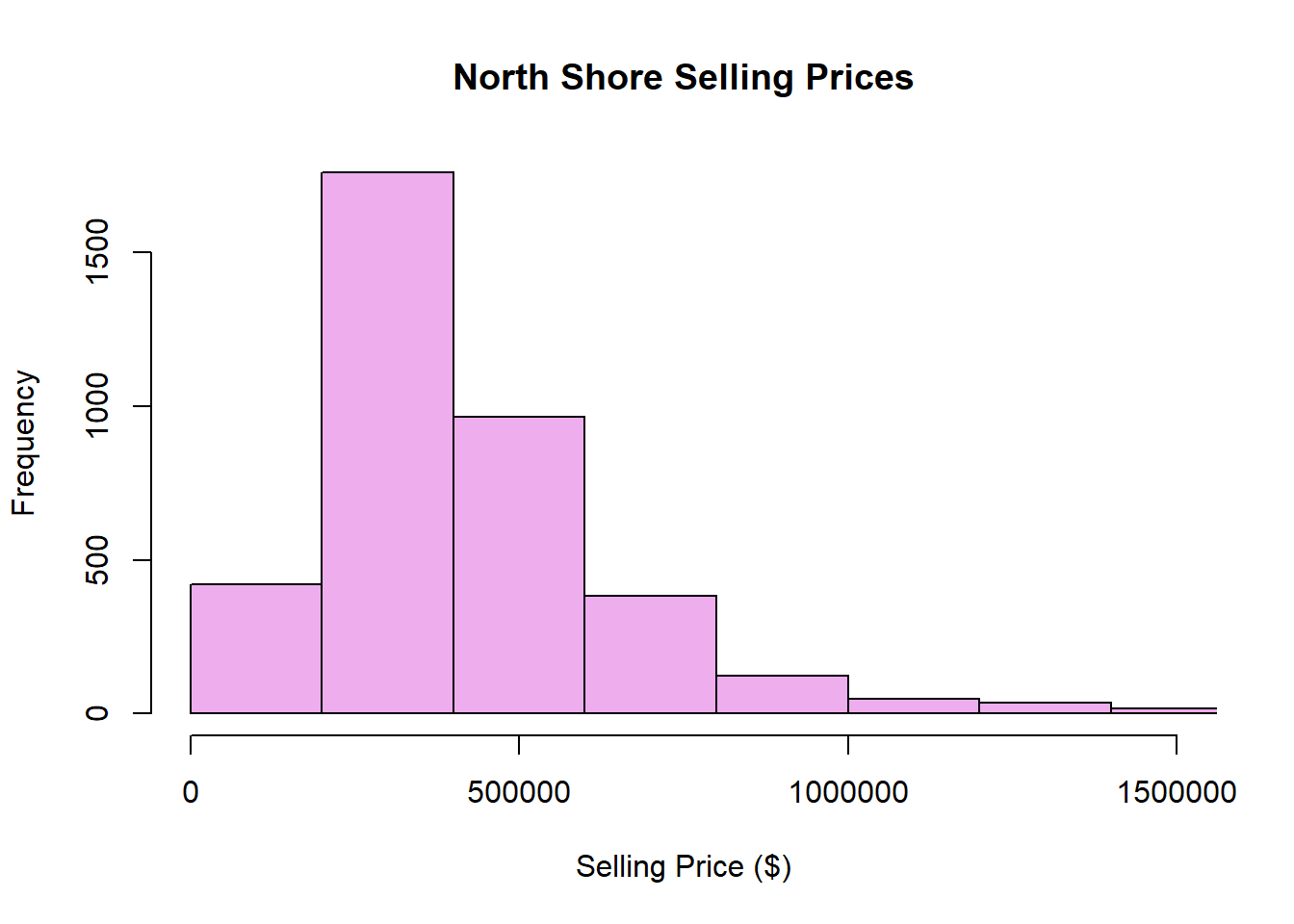

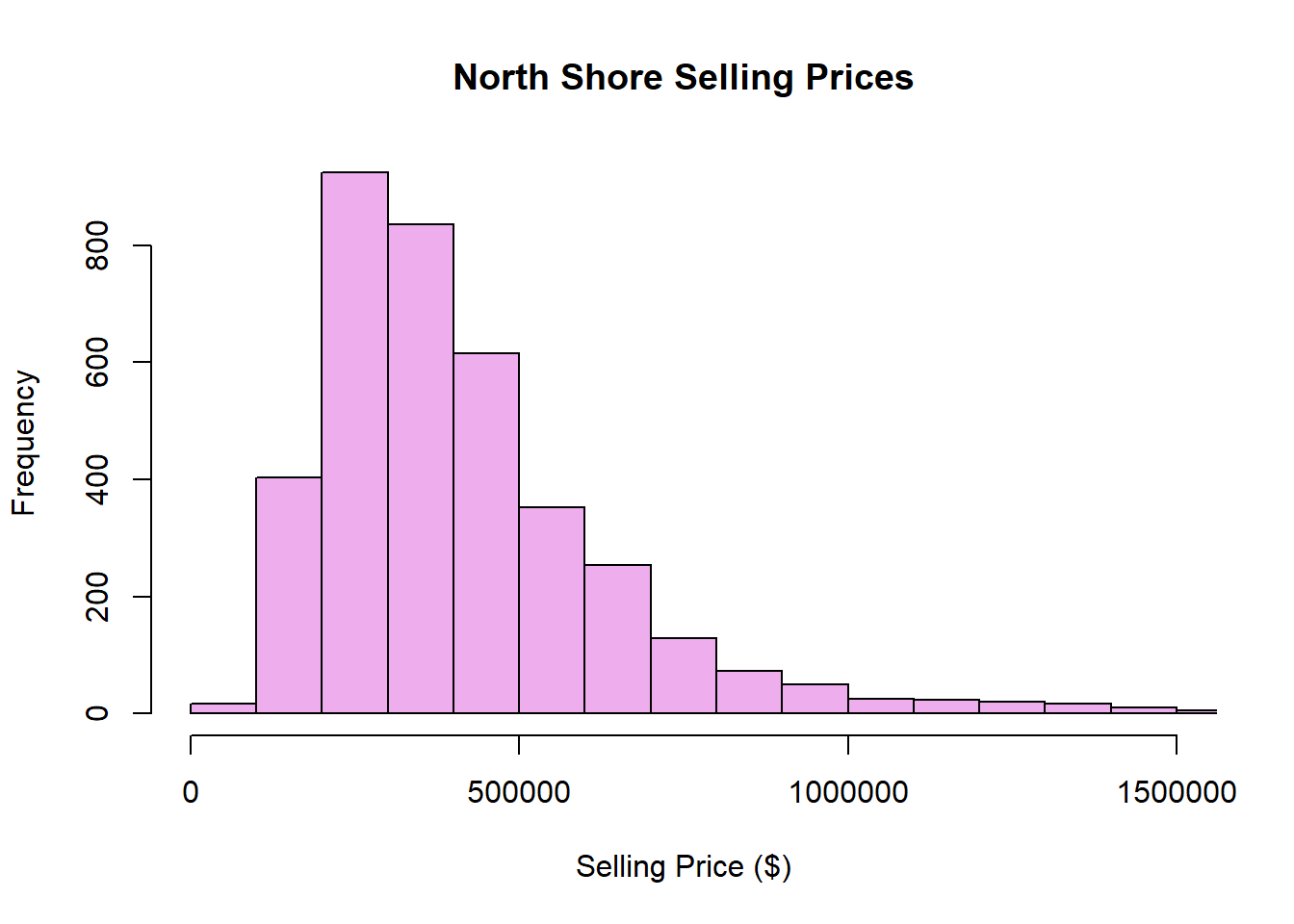

These features can also be examined visually using histograms. Draw a histogram of Selling Price ($).

As well as indicating col= using numbers or factor variables, we can provide specific colour names. The histogram below shows an example of this, you can google R colour palette to see more built-in colour options.

Code

hist(property$`Selling Price ($)`,xlab="Selling Price ($)", main="North Shore Selling Prices", col="plum2",xlim=c(0,1500000),breaks=50)Consider what we could change in the code below to show more detail in the histogram.

Code

#less breaks, less detail

hist(property$`Selling Price ($)`,xlab="Selling Price ($)", main="North Shore Selling Prices", col="plum2",xlim=c(0,1500000),breaks=50)

Code

#more breaks, more detail

hist(property$`Selling Price ($)`,xlab="Selling Price ($)", main="North Shore Selling Prices", col="plum2",xlim=c(0,1500000),breaks=100)

The distribution of North shore selling prices is unimodal with a peak of approximately $250,000. It is right skewed (even after excluding extreme values).

1c. Cleaning the data

As we have seen in the video, there are some problems with this data. For example, some residential properties (Type = R) have no bedroom (i.e. Number of Bedrooms = 0) !

Since a residential house without any bedroom does not make sense, it is most likely that the number of bedrooms in these properties is simply missing (e.g. unknown or not recorded) rather than 0.

Correct the data of these mistaken properties by changing the value in the Number of Bedrooms column from 0 to NA (as NA denotes a missing value).

Open the property data frame in a new tab by running the code below.

Code

View(property)Click the Filter button, then in the box at the top of the Type column type “R” to filter residential properties. We can see there are 3 properties of Type = R that have no bedrooms. We will replace these 0s with NAs.

Code

#finding the rows of property corresponding to Type=R with 0 bedrooms, then indicating the Number of Bedrooms column (column 9).

#Overwriting these entries with NA

property[which(property$`Number of Bedrooms`=="0"&property$Type=="R"),9]<-NACheck the data frame again using the Filter procedure above, the first 3 entries of Number of Bedrooms when Type=R should now be NA.

Repeat this for the other mistaken property values mentioned in the video.

Open the property data frame in a new tab by running the code below.

Code

View(property)Click the Filter button, then in the box at the top of the Type column type “R” to filter residential properties. We can see there are 3 properties of Type = R that have no bedrooms. We will replace these 0s with NAs.

Code

#finding the rows of property corresponding to Type=R with 0 bedrooms, then indicating the Number of Bedrooms column (column 9).

#Overwriting these entries with NA

property[which(property$`Number of Bedrooms`=="0"&property$Type=="R"),9]<-NACheck the data frame again using the Filter procedure above, the first 3 entries of Number of Bedrooms when Type=R should now be NA.

2. Summary Tables, Bar Plots

2a. Summary Tables

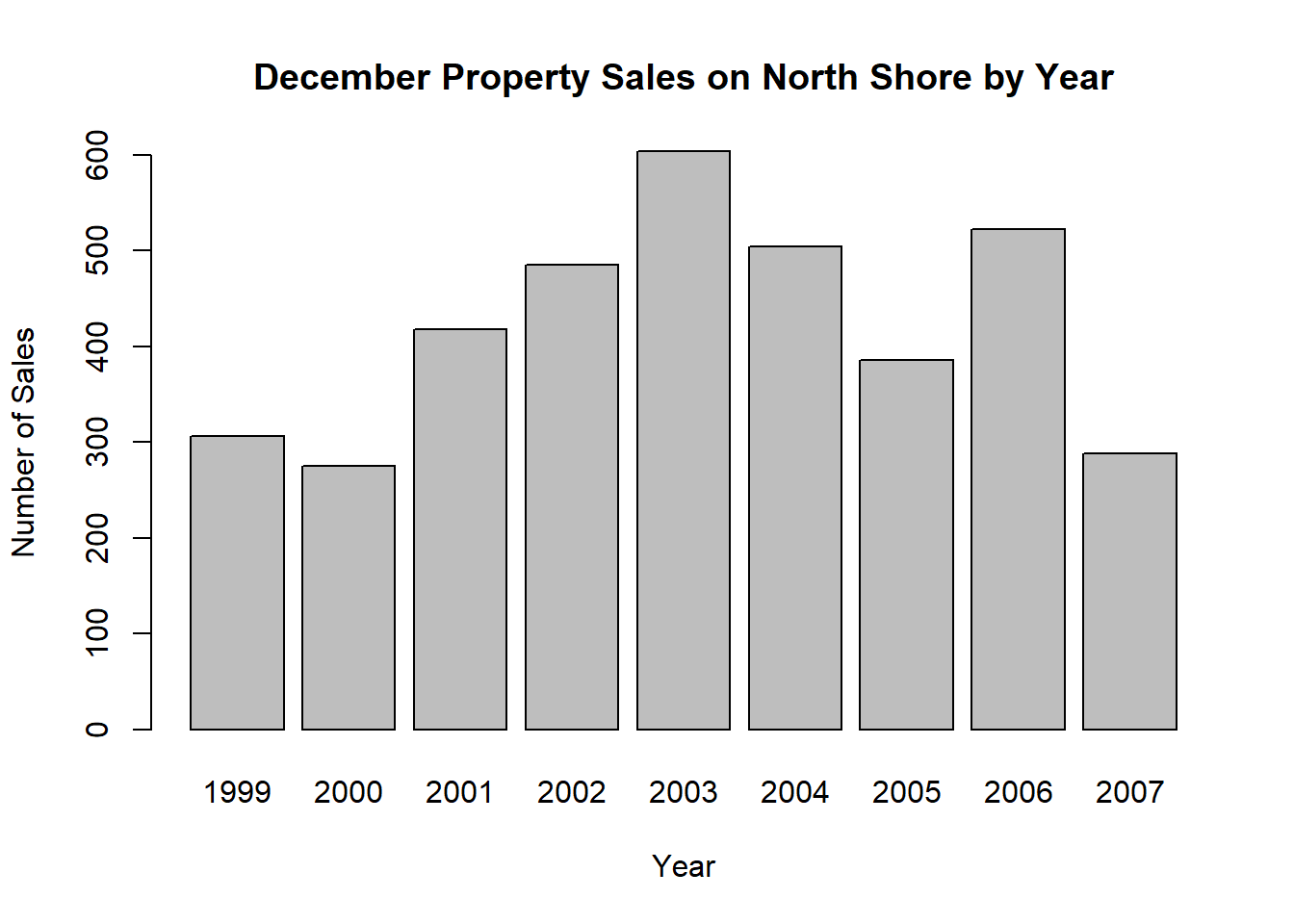

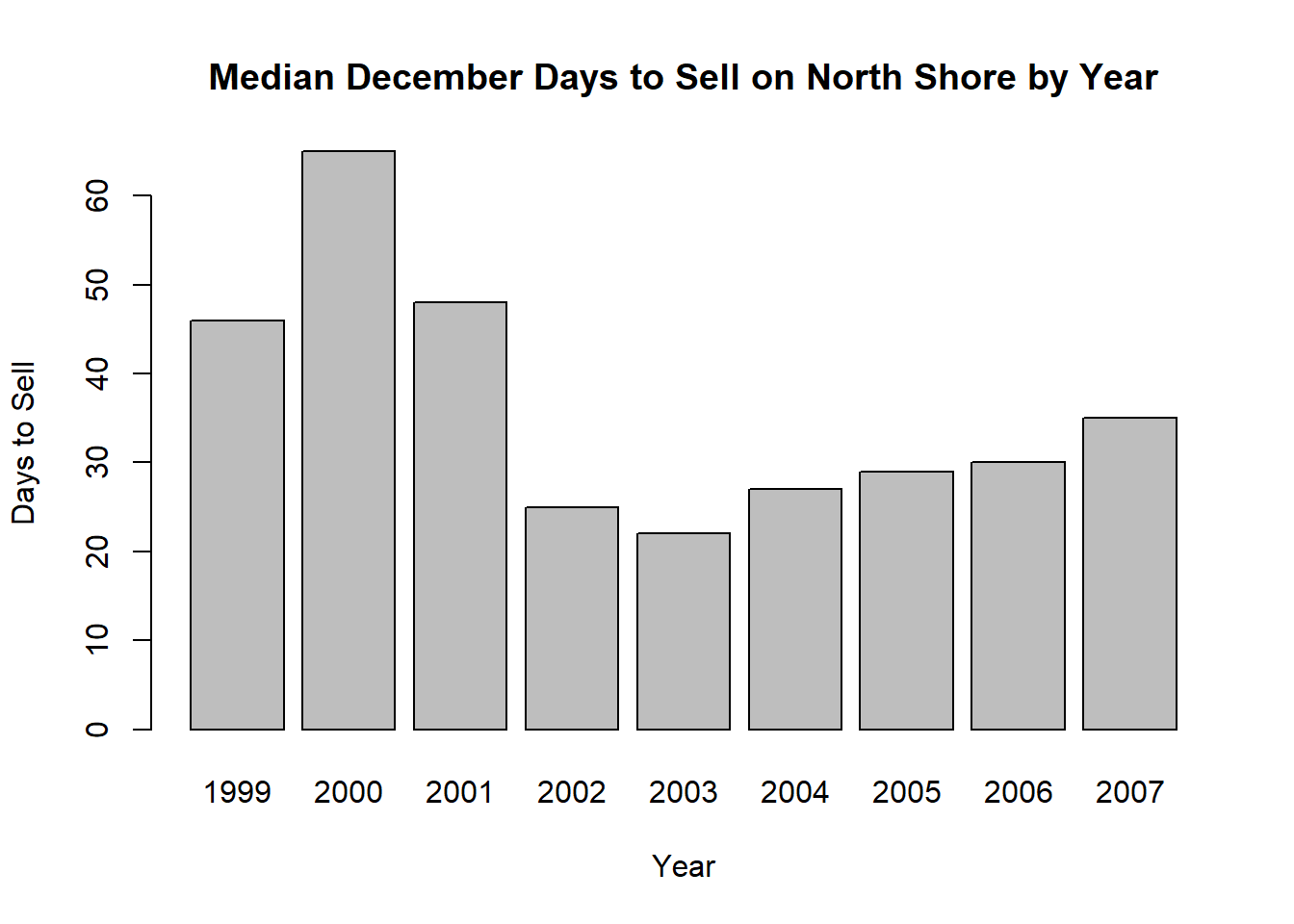

Investigate the way the North Shore property market has been performing between 1999 and 2007, by examining changes in Number of Sales, the median Number of Days to Sell a property, and the median Selling Price ($) per December month.

This can be carried out using the function tapply().

Getting the length of Selling Price ($) for each Year is a proxy for the number of sales that year.

Code

tapply(property$`Selling Price ($)`,INDEX=property$Year,FUN=length)It is a similar process to find the median Days to Sell by December month. There are some NAs in the Days to Sell column, so we want to remove these when calculating the median.

Code

tapply(property$`Days to Sell`,INDEX=property$Year,FUN=median,na.rm=T)Finally, modify code above to calculate the median Selling Price($) by December month.

Getting the length of Selling Price ($) for each Year is a proxy for the number of sales that year.

Code

tapply(property$`Selling Price ($)`,INDEX=property$Year,FUN=length)1999 2000 2001 2002 2003 2004 2005 2006 2007

306 275 418 485 604 504 386 522 288 It is a similar process to find the median Days to Sell by December month. There are some NAs in the Days to Sell column, so we want to remove these when calculating the median.

Code

tapply(property$`Days to Sell`,INDEX=property$Year,FUN=median,na.rm=T)1999 2000 2001 2002 2003 2004 2005 2006 2007

46 65 48 25 22 27 29 30 35 Calculate the median Selling Price($) by December month.

Code

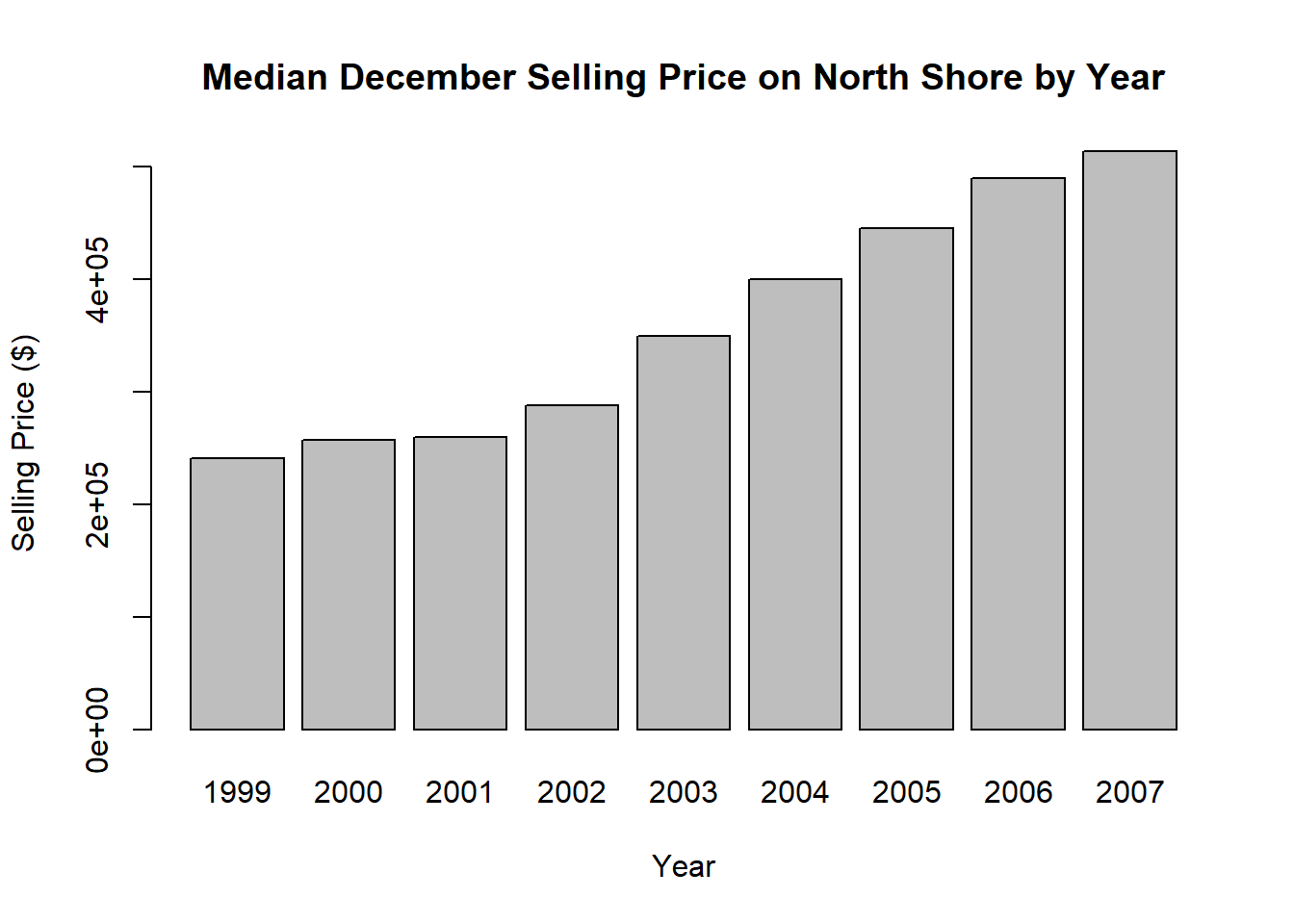

tapply(property$`Selling Price ($)`,INDEX=property$Year,FUN=median,na.rm=T) 1999 2000 2001 2002 2003 2004 2005 2006 2007

240500 257000 260000 287500 349500 400000 445000 490000 513750 There does not appear to be a pattern in the number of property sales per year or the number of days to sell, aside from some correspondence between less days to sell and a greater number of sales (equally, more days to sell and a smaller number of sales).

There is a clear upward trend in median selling price by year.

2b. Bar Plot

We can create bar plots of these statistics for easier interpretation.

For the Number of Sales per December month we assign the tapply() command we used earlier to an object called salesTable, then can create a bar plot using the function barplot() on this.

Code

salesTable<-tapply(property$`Selling Price ($)`,INDEX=property$Year,FUN=length)

barplot(salesTable,xlab="Year",ylab="Number of Sales",main="December Property Sales on North Shore by Year")Generate bar plots for median Days to Sell and median Selling Price ($) per December month.

Code

#Number of sales

salesTable<-tapply(property$`Selling Price ($)`,INDEX=property$Year,FUN=length)

barplot(salesTable,xlab="Year",ylab="Number of Sales",main="December Property Sales on North Shore by Year")

Code

#Median days to sell

salesTable2<-tapply(property$`Days to Sell`,INDEX=property$Year,FUN=median,na.rm=TRUE)

barplot(salesTable2,xlab="Year",ylab="Days to Sell",main="Median December Days to Sell on North Shore by Year")

Code

#Median selling price

salesTable3<-tapply(property$`Selling Price ($)`,INDEX=property$Year,FUN=median,na.rm=TRUE)

barplot(salesTable3,xlab="Year",ylab="Selling Price ($)",main="Median December Selling Price on North Shore by Year")

These bar plots make it easier to identify the patterns previously discussed. We can also see that the median days to sell dropped quite dramatically from 2001 to 2002, and has been slowly increasing since then.

2c. Multiple Bar Plots

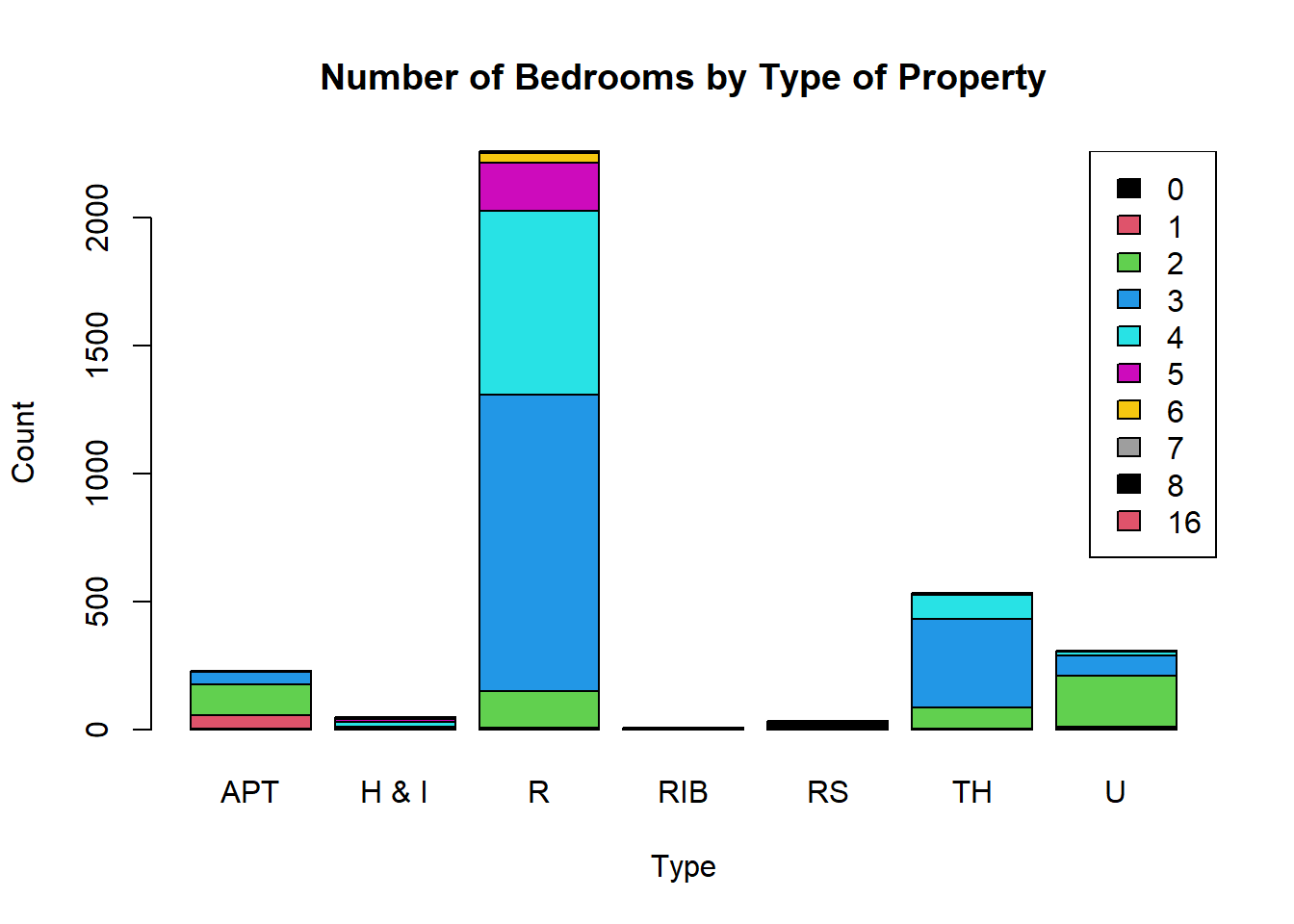

Construct a table showing the relationship between Number of Bedrooms and Type of property, this can be achieved using the table() function.

Using this table, draw a stacked bar graph to investigate the Number of Bedrooms each Type of properties has.

Code

#dnn= can be provided a vector of the variable names, so it displays these on the table

table(property$`Number of Bedrooms`,property$Type,dnn=c("Number of Bedrooms","Type")) Code

#convert table above (without variable names) into a matrix to supply heights to bars

propertyMatrix<-as.matrix(table(property$`Number of Bedrooms`,property$Type))

#barplot, with bars corresponding to the same type of property stacked on top of each other (beside=FALSE).

#The other arguments work in the same way as they have been used for previous plots e.g labelling axes, giving colour for different bars.

barplot(propertyMatrix,beside=FALSE,names=c("APT","H & I","R","RIB","RS","TH","U"),col=1:14,

ylab="Count",xlab="Type",main="Number of Bedrooms by Type of Property")

#legend

#since our bar plot has filled bars rather than points, we can display squares of colour on our legend using fill= instead of col=

legend("topright",legend=levels(as.factor(property$`Number of Bedrooms`)),fill= 1:14)We can get a better view of the plot by clicking the Show in New Window button in the top right corner.

Code

#dnn= can be provided a vector of the variable names, so it displays these on the table

table(property$`Number of Bedrooms`,property$Type,dnn=c("Number of Bedrooms","Type")) Type

Number of Bedrooms APT H&I R RIB RS TH U

0 3 1 0 0 29 0 1

1 54 0 7 0 0 4 9

2 118 0 143 2 1 83 200

3 50 8 1157 2 2 346 80

4 5 21 722 1 0 93 12

5 0 10 188 0 0 4 2

6 0 5 35 1 0 2 2

7 0 2 7 0 0 0 0

8 0 0 2 0 0 0 0

16 0 0 0 1 0 0 0Code

#convert table above (without variable names) into a matrix to supply heights to bars

propertyMatrix<-as.matrix(table(property$`Number of Bedrooms`,property$Type))

#barplot, with bars corresponding to the same type of property stacked on top of each other (beside=FALSE).

#The other arguments work in the same way as they have been used for previous plots e.g labelling axes, giving colour for different bars.

barplot(propertyMatrix,beside=FALSE,names=c("APT","H & I","R","RIB","RS","TH","U"),col=1:14,

ylab="Count",xlab="Type",main="Number of Bedrooms by Type of Property")

#legend

#since our bar plot has filled bars rather than points, we can display squares of colour on our legend using fill= instead of col=

legend("topright",legend=levels(as.factor(property$`Number of Bedrooms`)),fill= 1:14)

We can get a better view of the plot by clicking the Show in New Window button in the top right corner.

Apartments have a fairly even split between 1, 2 and 3 bedrooms. 3 or 4 bedrooms are most common for residential properties, with a good proportion of 5 bedroom properties too. All residential sections have no bedrooms (as they are purchased without houses). Units tend to be slightly larger than apartments, having 2 or 3 bedrooms, and town houses are a bit larger than these with 2-4 bedrooms.

3. Box Plots

3a. Box Plot (response by predictor)

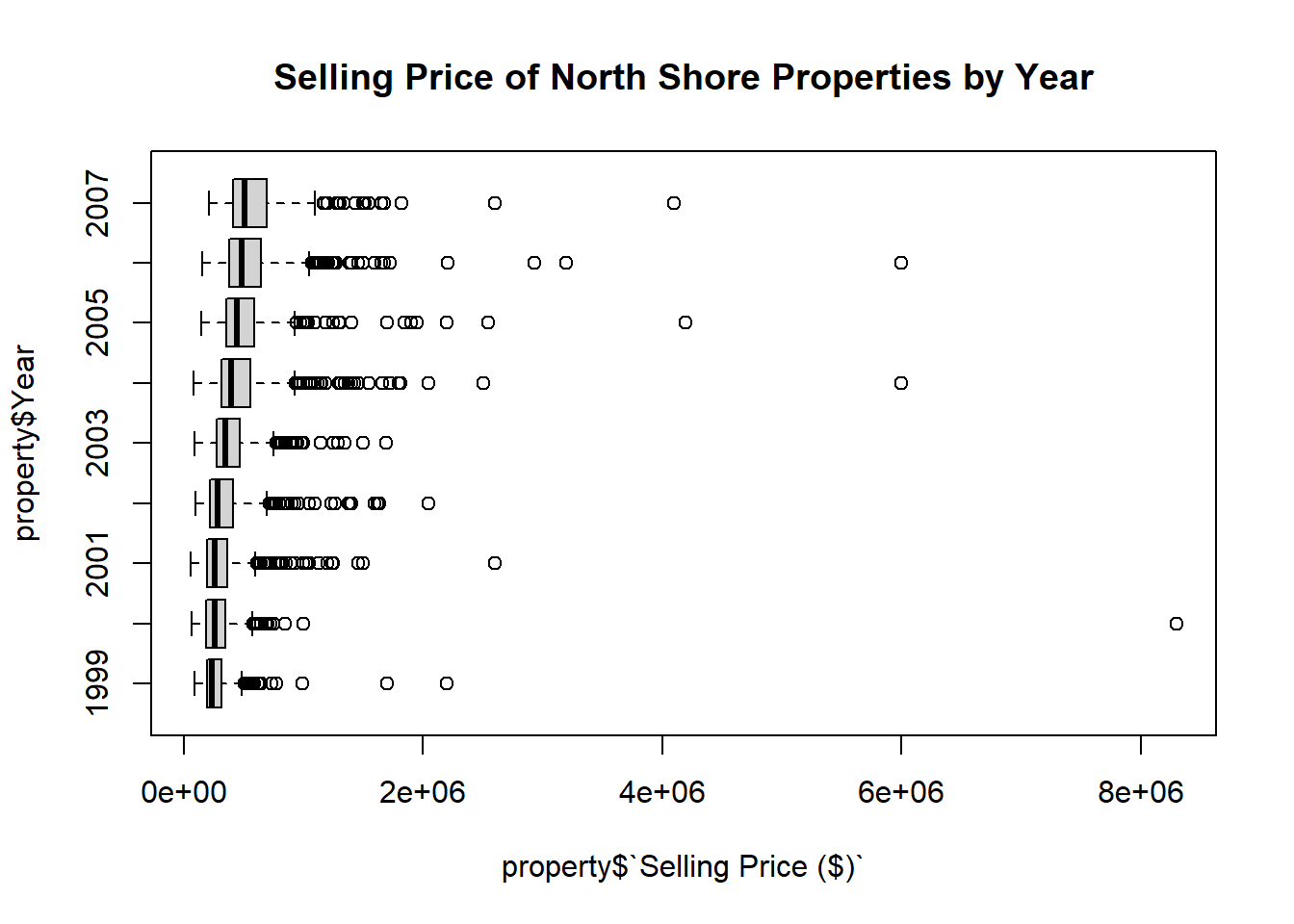

Investigate the changes in the median Selling Price ($) of the North Shore properties between Years 1999 and 2007 using box plots.

Code

boxplot(property$`Selling Price ($)`~property$Year,horizontal=T, main="Selling Price of North Shore Properties by Year")Code

boxplot(property$`Selling Price ($)`~property$Year,horizontal=T, main="Selling Price of North Shore Properties by Year")

3b. Box Plots (subsetting)

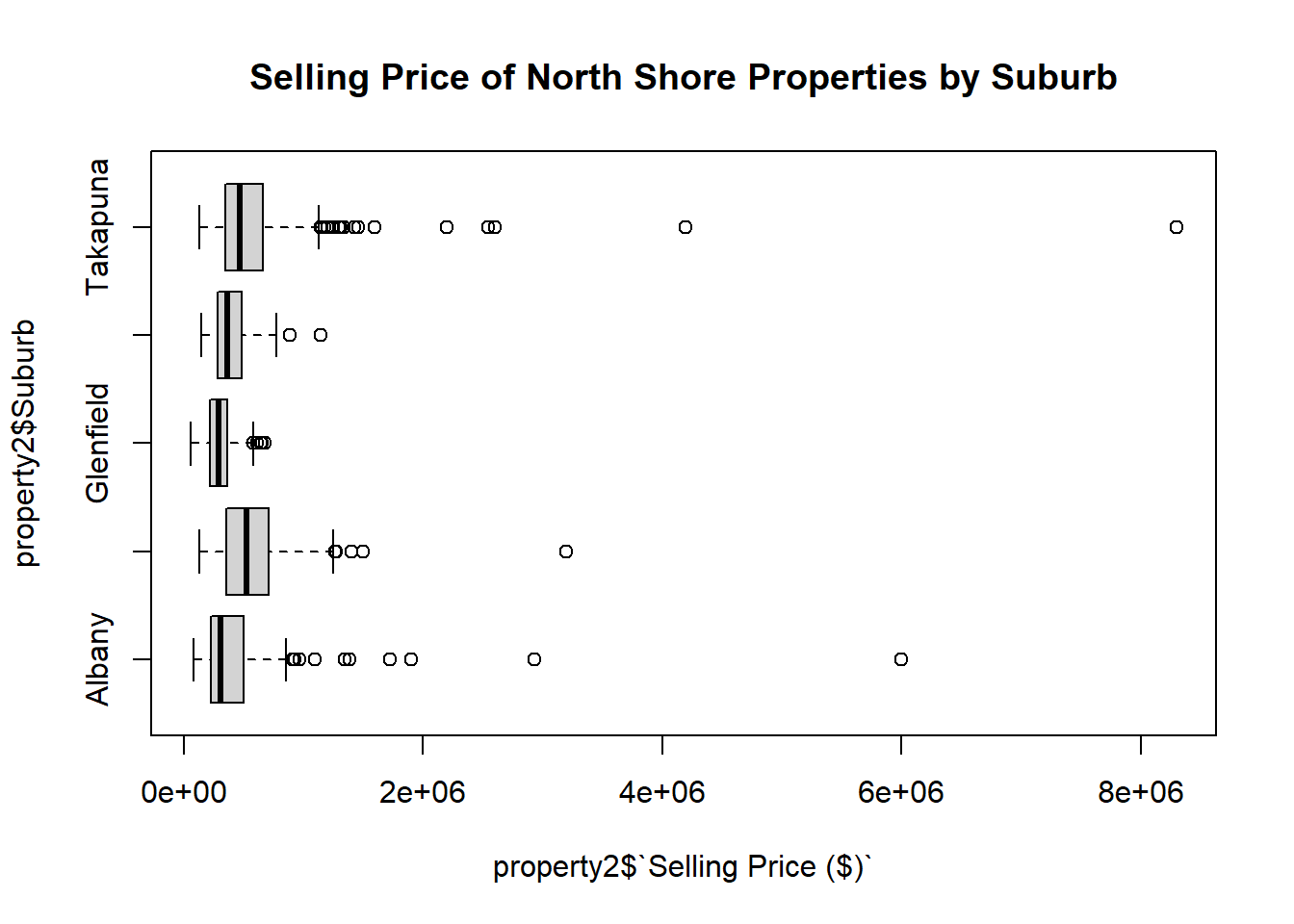

Draw a box plot of Selling Price ($) grouped by Suburb.

Since there are 49 different suburbs in this data, we cannot include all of them at once if we want an interpretable graph. You can try this by modifying the code, and will see the box plots are too small and squished to give us any useful information.

Instead, first create a subset of the data frame containing only data that corresponds to the Suburbs - Albany OR Devonport OR Glenfield OR Northcote OR Takapuna. Then construct a box plot using this data.

Code

property2<-property[which(property$Suburb=="Albany"|property$Suburb=="Devonport"|property$Suburb=="Glenfield"|property$Suburb=="Northcote"|property$Suburb=="Takapuna"),]Code

boxplot(property2$`Selling Price ($)`~property2$Suburb,horizontal=T, main="Selling Price of North Shore Properties by Suburb")Code

property2<-property[which(property$Suburb=="Albany"|property$Suburb=="Devonport"|property$Suburb=="Glenfield"|property$Suburb=="Northcote"|property$Suburb=="Takapuna"),]Code

boxplot(property2$`Selling Price ($)`~property2$Suburb,horizontal=T, main="Selling Price of North Shore Properties by Suburb")

3c. Box Plots (subsetting)

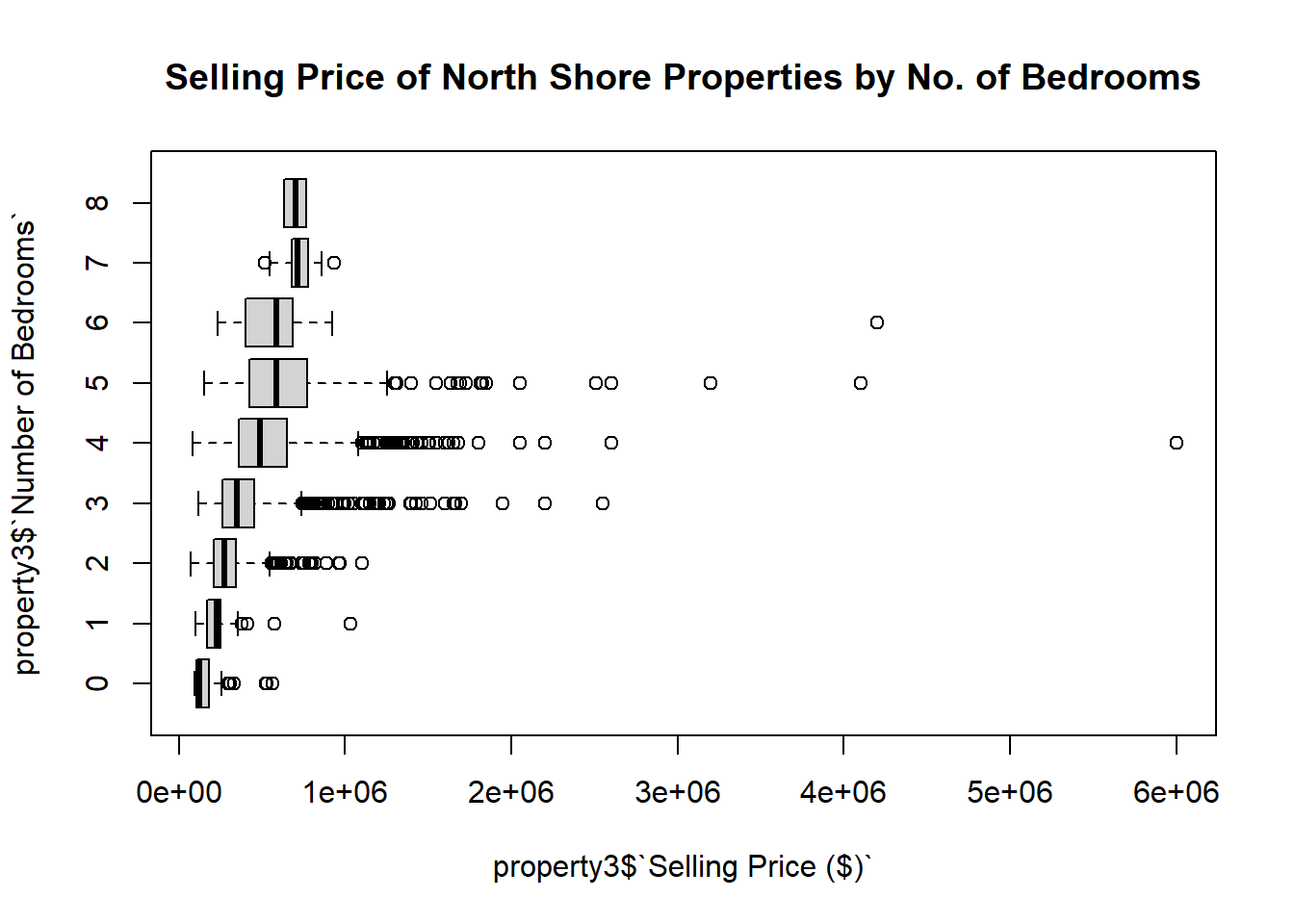

Draw a box plot of Selling Price ($) grouped by Number of Bedrooms.

Since the data contains only one property with 16 bedrooms, first create a subset of the data which removes this property.

Code

#subsets data frame to only include rows where properties do not have 16 bedrooms

property3<-property[which(property$`Number of Bedrooms`!="16"),] Try to create the box plot first, then reveal the code below.

Code

boxplot(property3$`Selling Price ($)`~property3$`Number of Bedrooms`,horizontal=T, main="Selling Price of North Shore Properties by No. of Bedrooms")Code

#subsets data frame to only include rows where properties do not have 16 bedrooms

property3<-property[which(property$`Number of Bedrooms`!="16"),] Try to create the box plot first, then reveal the code below.

Code

boxplot(property3$`Selling Price ($)`~property3$`Number of Bedrooms`,horizontal=T, main="Selling Price of North Shore Properties by No. of Bedrooms")

4. New Variables, Histograms

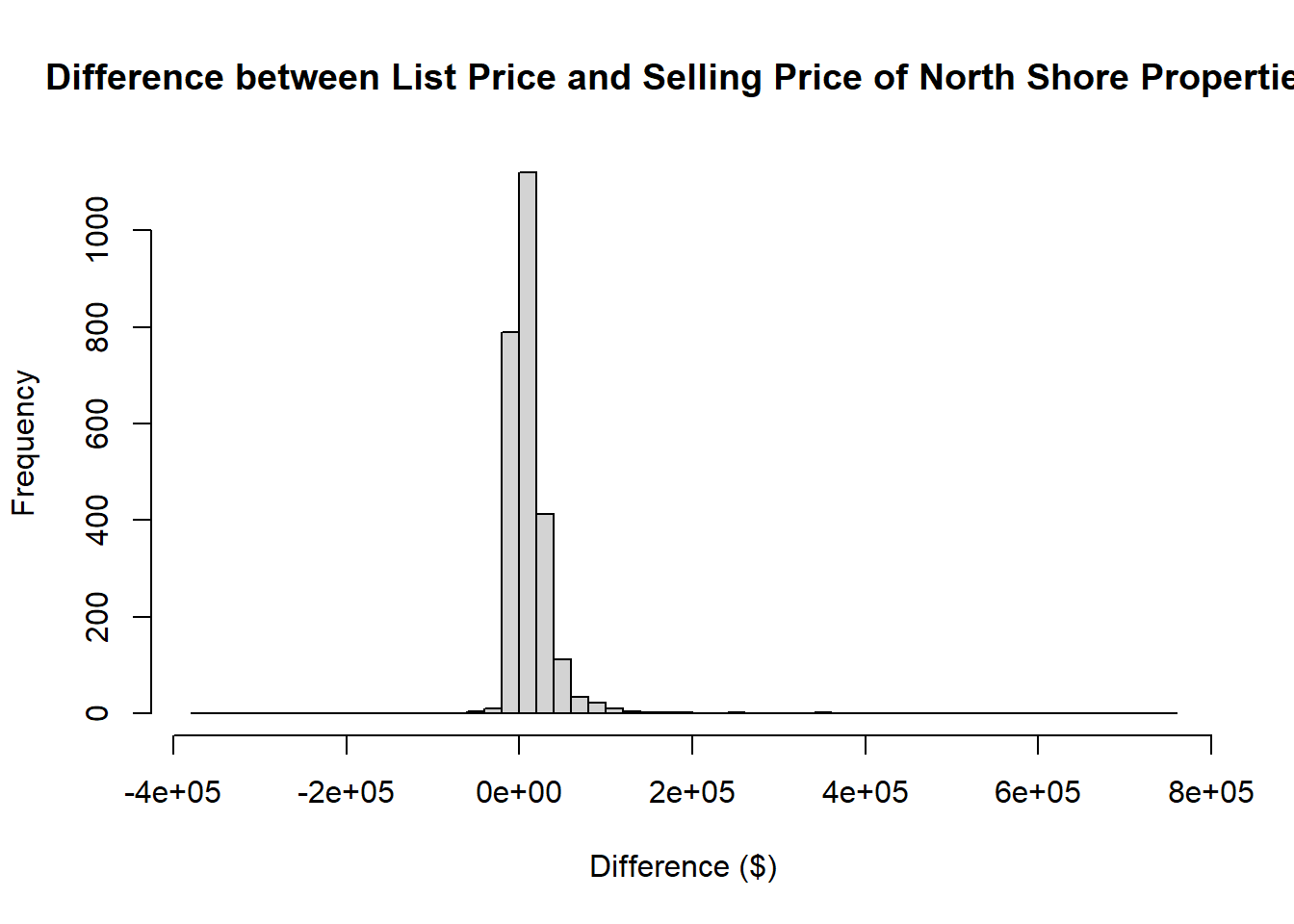

Investigate how the List Price compares to the Selling Price ($) for the North Shore properties sold between 1999 and 2007 by drawing a histogram.

We want to only include rows where values of List Price are not equal to 0, as when List Price=0 this is equivalent to the data being missing. From these values, calculate a new variable Diff Price that is equal to the difference between List Price and the Selling Price ($) and plot a histogram of this.

Include only List Price values not equal to 0.

Code

property4<-property[which(property$`List Price`!=0),]Calculate new variable of the difference between List Price and Selling Price.

Code

property4$`Diff Price`<-property4$`List Price`- property4$`Selling Price ($)`Create a histogram, complete with labels and an appropriate number of breaks, for Diff Price.

Code

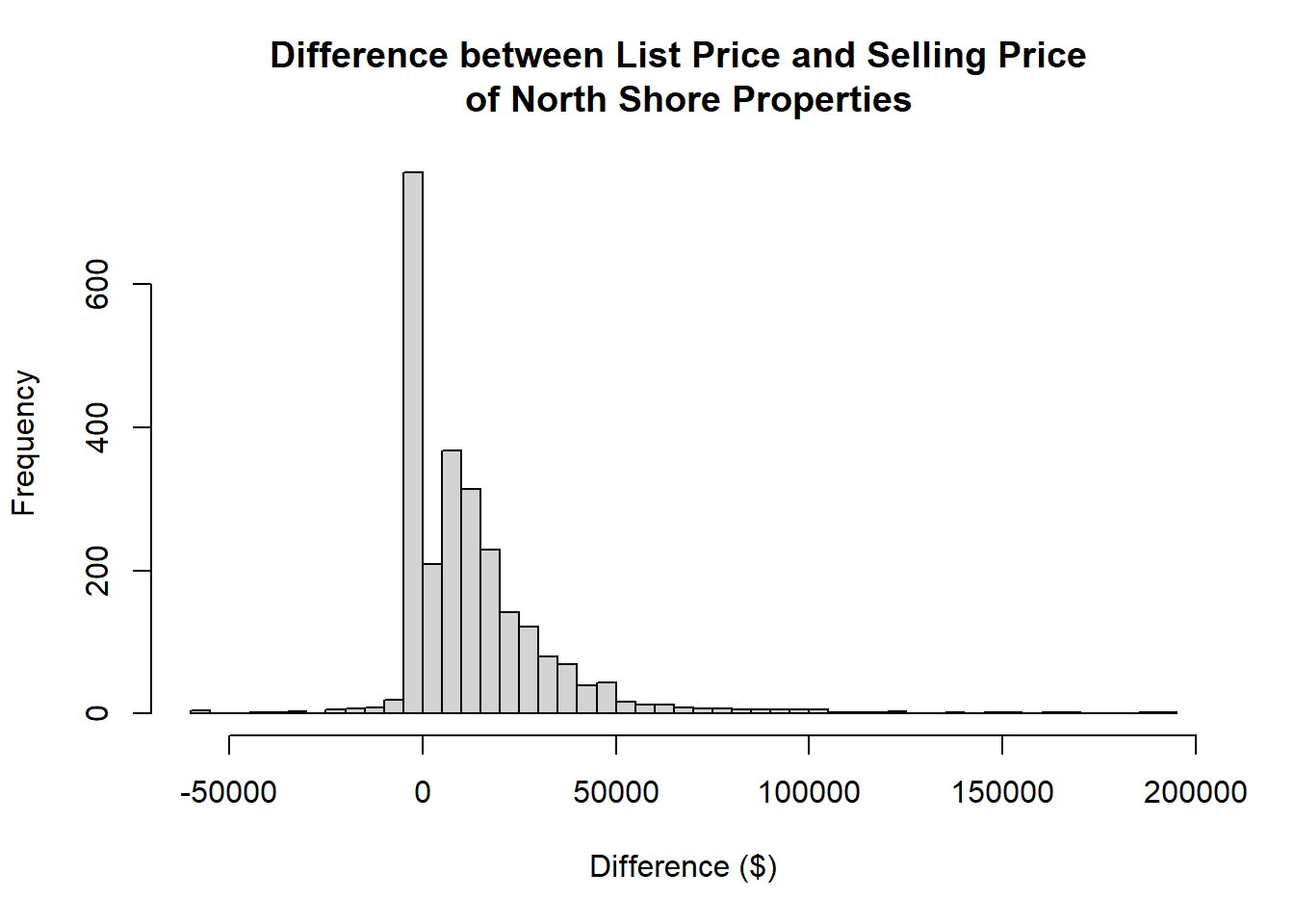

hist(property4$`Diff Price`,xlab="Difference ($)", main="Difference between List Price and Selling Price of North Shore Properties",breaks=50)Exclude the few very large positive and negative difference to get a better picture of the distribution of most values.

Code

#new data frame which only includes properties where the difference between list and selling price lies between -60000 and 200000

property5<-property4[which(-60000<=property4$`Diff Price`&property4$`Diff Price`<=200000),]

#we have excluded 12 properties

nrow(property4)

nrow(property5) Create a second histogram, complete with labels and an appropriate number of breaks, for Diff Price in this reduced data frame.

Code

hist(property5$`Diff Price`,xlab="Difference ($)", main="Difference between List Price and Selling Price \n of North Shore Properties",breaks=50)Code

property4<-property[which(property$`List Price`!=0),]Code

property4$`Diff Price`<-property4$`List Price`- property4$`Selling Price ($)`Code

hist(property4$`Diff Price`,xlab="Difference ($)", main="Difference between List Price and Selling Price of North Shore Properties",breaks=50)

Code

#new data frame which only includes properties where the difference between list and selling price lies between -60000 and 200000

property5<-property4[which(-60000<=property4$`Diff Price`&property4$`Diff Price`<=200000),]

#we have excluded 12 properties

nrow(property4)[1] 2540Code

nrow(property5) [1] 2528Code

hist(property5$`Diff Price`,xlab="Difference ($)", main="Difference between List Price and Selling Price \n of North Shore Properties",breaks=50)

5. New Variables, Box Plots

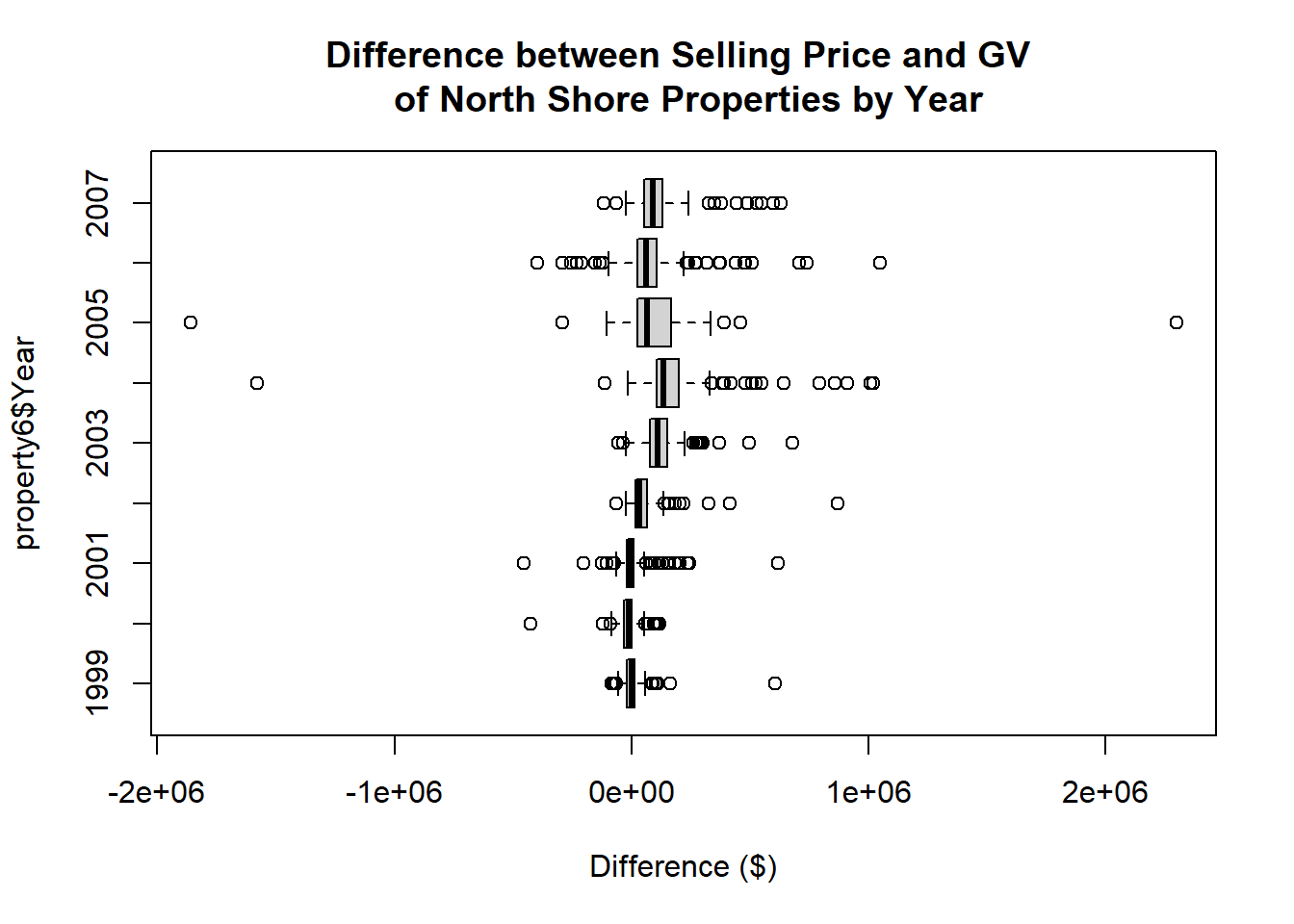

Investigate how the Selling Price ($) compares to the Government Valuation (GV) for the North Shore properties sold between 1999 and 2007, using box plots.

Exclude values where GV is equal to 0, as this is equivalent to the data being missing.

There are also two other properties whose GV values are mistaken as 1050 and 430, instead of 1050000 and 430000 respectively. Hence, correct these values.

Calculate the difference between the Selling Price ($) and the GV to make a new variable GV Diff Price.

Finally, draw a box plot of the difference between Selling Price ($) and GV.

Include only values where GV is not equal to 0.

Code

#subsetting property to include only GV values that are not equal to 0

property6<-property[which(property$GV!=0),]Correct erroneous values.

Code

#finding the row of property corresponding to GV=430, then indicating the GV column (column 12).

#Overwriting this entry with 430000

property6[which(property6$GV=="430"),12]<-430000

property6[which(property6$GV=="1050"),12]<-1050000Calculate the difference between the Selling Price ($) and the GV.

Code

#calculating the difference

property6$`GV Diff Price`<- property6$`Selling Price ($)`-property6$GV Box plot of this difference variable by year.

Code

boxplot(property6$`GV Diff Price`~property6$Year,horizontal=T, main="Difference between Selling Price and GV \n of North Shore Properties by Year",xlab="Difference ($)")Code

#subsetting property to include only GV values that are not equal to 0

property6<-property[which(property$GV!=0),]Code

#finding the row of property corresponding to GV=430, then indicating the GV column (column 12).

#Overwriting this entry with 430000

property6[which(property6$GV=="430"),12]<-430000

property6[which(property6$GV=="1050"),12]<-1050000Code

#calculating the difference

property6$`GV Diff Price`<- property6$`Selling Price ($)`-property6$GV Code

boxplot(property6$`GV Diff Price`~property6$Year,horizontal=T, main="Difference between Selling Price and GV \n of North Shore Properties by Year",xlab="Difference ($)")

6. Extension: All techniques

If you wish to practice the techniques shown in this lesson some more, there are 2 additional sets of North Shore property data available.

The first has 6437 entries from 2006 to December 2007.

The second has 9281 entries from 2006 to December 2008.